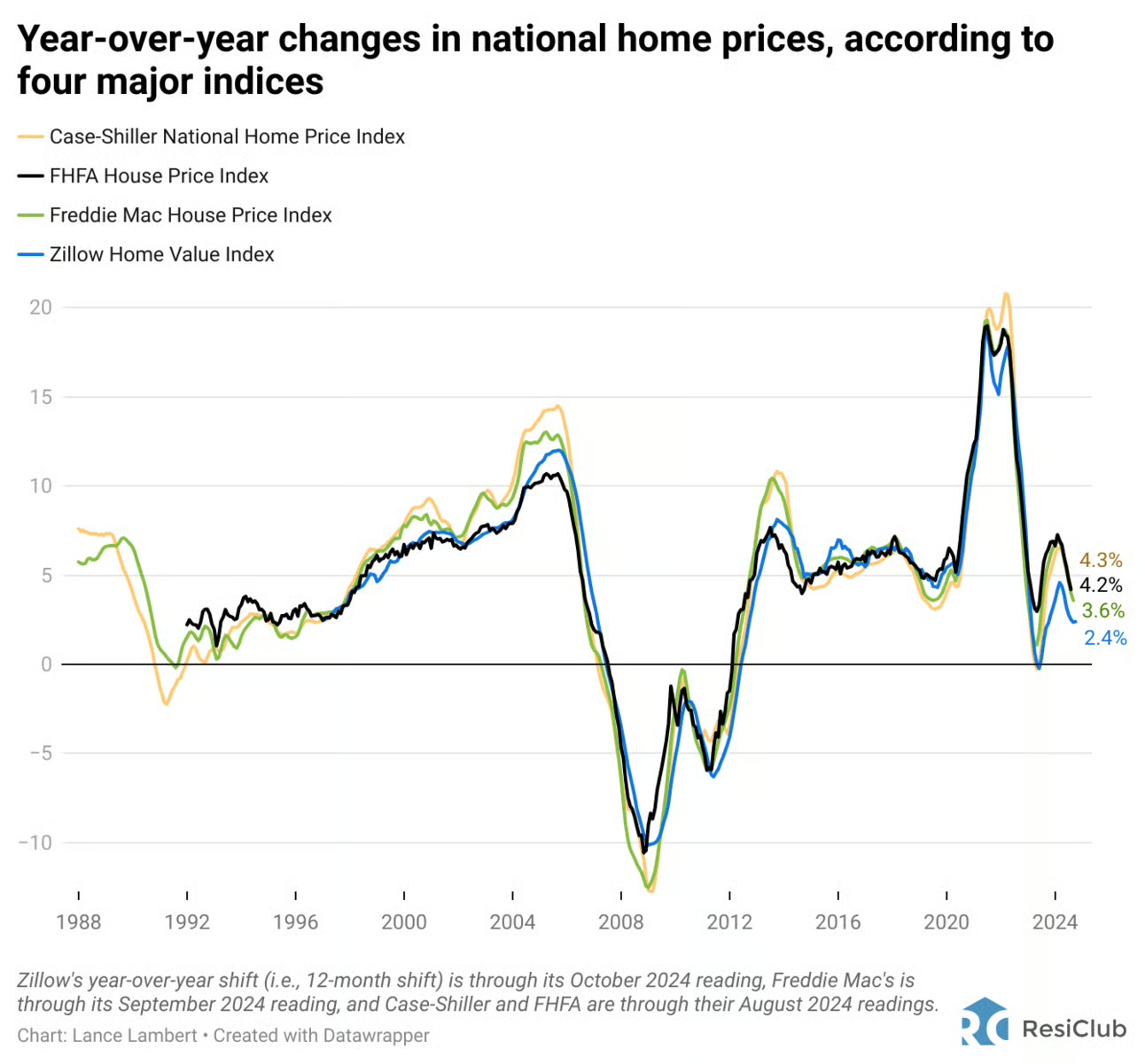

National Price Slowdown

The latest data reveals a marked deceleration in national home price growth throughout 2024. High mortgage rates, affordability issues, and a surge in inventory, especially in popular Sun Belt regions, have contributed to this cooling trend. October 2024 saw a slight dip in prices, suggesting a potential shift in market dynamics heading into 2025. That dip was more pronounced in Austin with the exception of specific high-demand sub-markets which have bucked the trend.

How This Affects Austin’s Market

In Austin, home prices have also felt the pinch. While the city remains a hot relocation hub, especially for tech professionals and high-income earners, the market dynamics have shifted. Listings have increased, giving buyers more options and negotiating power. This shift could mean better opportunities for those looking to upgrade into larger homes especially new construction homes where builders are able to offer greater concessions.

Key Points for Austin Buyers and Sellers:

- For Buyers: With a slowing market, there’s an increased chance of finding premium homes at more competitive prices. It’s an excellent time to explore Austin’s top neighborhoods where the worst outcome is paying ask price in many cases.

- For Sellers: To stay competitive, consider pricing strategies that reflect current market trends and focus on marketing high-quality features that appeal to discerning buyers. The homes that sell are the ones that represent the greatest value among those that are on the market at the same time. Value is always relative, and if you want to retain your negotiating power as a Seller, you must be the most attractive option in your class (or as close to it as possible).

Overall, Austin’s real estate remains resilient. Yes, we have seen extended days on market and slower volume of sales but it seems that the days of 10% off the ask price are over. The broader national slowdown creates a window for those looking to buy or sell in the coming months. Just as Austin was among the first places to correct, it will probably be among the first places to rebound as well.

Reach out to learn how these trends could impact your specific real estate goals.

Data sourced from ResiClub

Social Cookies

Social Cookies are used to enable you to share pages and content you find interesting throughout the website through third-party social networking or other websites (including, potentially for advertising purposes related to social networking).