The financial landscape last week brought a mix of opportunities and challenges, particularly relevant for the real estate market in Austin, TX. From falling mortgage rates to rising job openings, here’s a breakdown of what these economic trends mean for buyers, sellers, and investors in Austin’s dynamic housing market.

Mortgage Rates and Application Activity

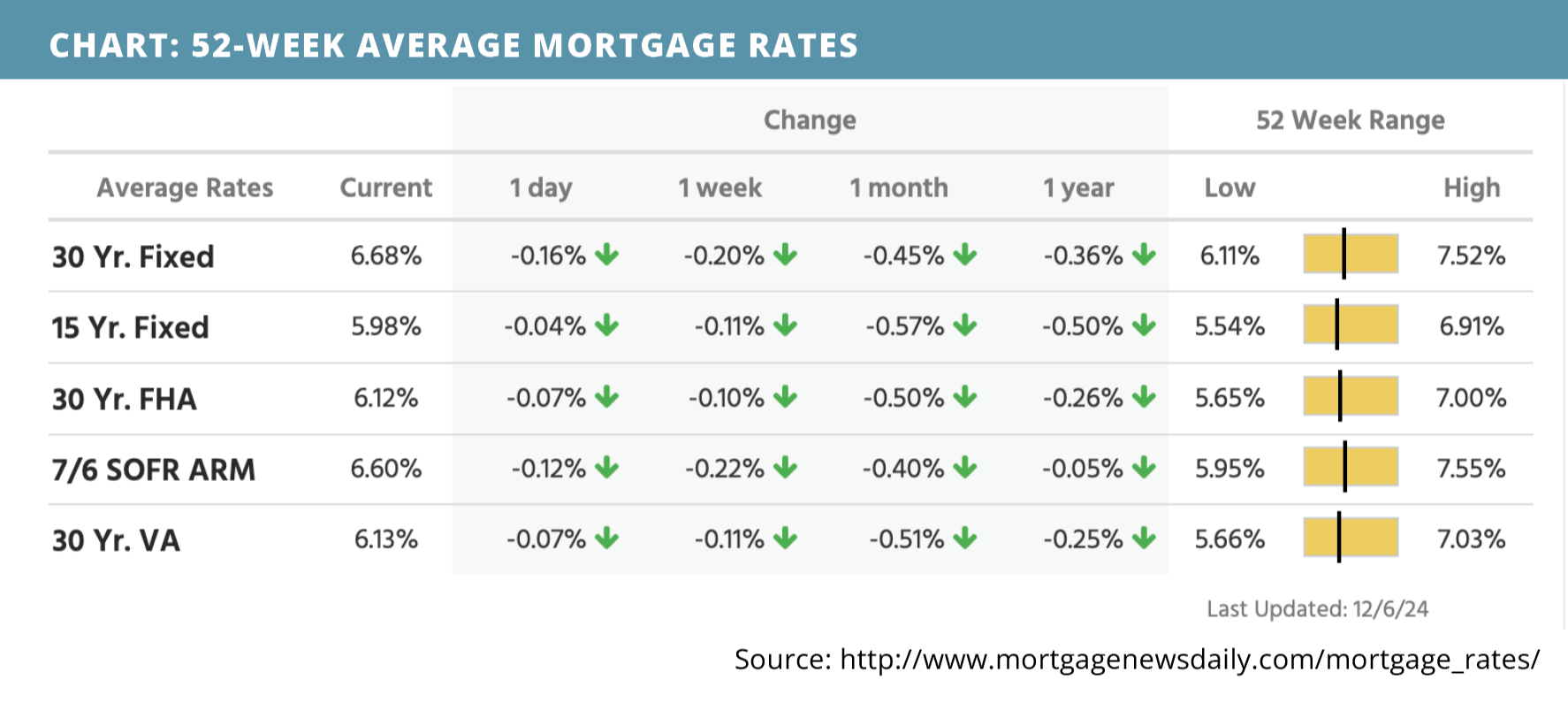

Mortgage rates trended lower, reaching their lowest level in over a month. This sparked a 6% jump in mortgage purchase demand during the week ending November 29, as prospective buyers took advantage of more favorable borrowing conditions. Notably, Austin’s housing market, with its competitive neighborhoods like Zilker, Mueller, and Downtown condos, could see a surge in buyer activity due to this renewed affordability.

Construction Spending and Job Openings

Construction spending rose by 0.4% in October, indicating steady investment in new developments. Additionally, job openings exceeded expectations, reaching 7.74 million in October. Robust job availability often signals greater economic confidence, which can translate into increased demand for housing. That should bode well for Sellers anticipating a strong spring market, and that then means Buyers should be thinking about acting before the spring market activates.

Labor Market Dynamics

The labor market presented mixed signals in November. While nonfarm payrolls exceeded expectations at 227,000 and private payrolls hit 194,000, the unemployment rate ticked up slightly to 4.2%. Meanwhile, average hourly earnings rose by 0.4%, and the average workweek lengthened to 34.3 hours. In Austin, this mix of rising wages and job security supports the ability of buyers to navigate higher price points, particularly for homes in premium neighborhoods like Travis Heights and East Austin.

Consumer Credit and Spending

Consumer credit surged to $19.24 billion in October, nearly doubling expectations. This spike reflects a strong appetite for borrowing, potentially aiding in down payments or home improvement investments. For Austin’s market, where customization of properties such as backyard cottages or condo-regime units is common, this trend could fuel continued buyer interest.

What It Means for Austin Real Estate

With mortgage rates trending lower and job markets showcasing resilience, the Austin real estate market stands poised for steady activity. However, with inflationary pressures and rising consumer credit, buyers and sellers alike must approach the market strategically. Whether exploring Downtown condos, new construction homes, or unique multigenerational setups like A-B units, understanding current trends will be crucial to success.

For personalized insights and strategies tailored to Austin’s neighborhoods, contact us today. Let’s make your real estate goals a reality in this ever-evolving market.

Sources: CMG Home Loans, John Nagle; Mortgage News Daily

Rates Snapshot

Social Cookies

Social Cookies are used to enable you to share pages and content you find interesting throughout the website through third-party social networking or other websites (including, potentially for advertising purposes related to social networking).